Where travel agents earn, learn and save!

News / European aviation bumps along the bottom ahead of a summer climb

Europe has 7.1 million seats vs 28.4 million in the same week of 2019, down 75%

March 22 - EUROCONTROL DG Eamonn Brennan told CAPA Live on March 10, 20201 that April 2021 flight plans filed with the agency remained depressed.

However, plans from May 2021 suggest that European operations will pick up across the summer, led by short haul leisure. Long haul is likely to start with US-UK, given their advanced rates of vaccination.

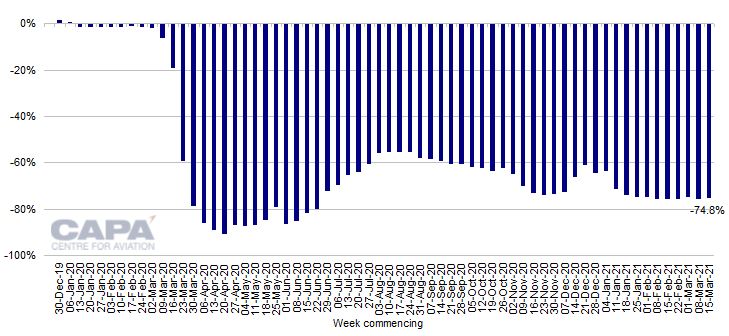

For now, Europe’s capacity continues to lag the rest of the world, falling by 74.8% versus 2019 in the week of March 15, 2021, according to OAG schedules and CAPA seat configurations. Middle East is down by 56.3%, Africa is down by 54.5%, North America by 38.6%, Latin America by 48.7% and Asia Pacific by 32.2%.

Europe has been at approximately 25% of 2019 capacity for nine weeks. This is the lowest since operations restarted in early summer 2020, after the almost complete grounding of fleets in the first months of the COVID-19 pandemic.

OAG schedules currently imply 37% of 2019 seats in April 2021, rising to 80% in July 2021. In reality, the curve is likely to slope up less steeply than that, but European aviation activity is bumping along the bottom in anticipation of a summer climb.

Europe has 7.1 million seats vs 28.4 million in 2019 – down 75%

In the week commencing March 15, 2021, total European seat capacity is scheduled to be 7.1 million.

This is 74.8% below the 28.4 million seats of the equivalent week of 2019 and the ninth consecutive week of a similar rate of decline. It is the 52nd week of very heavy double digit percentage (more than 50%) declines in seats versus.

This week’s total seat capacity for Europe is split between 3.3 million domestic seats, versus 7.4 million in the equivalent week of 2019; and 3.8 million international seats, versus 21.0 million.

Europe’s domestic seats are down by 55.0% versus 2019, compared with last week’s -55.3%.

International seat capacity is down by 81.8% versus 2019, compared with last week’s -82.4%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019

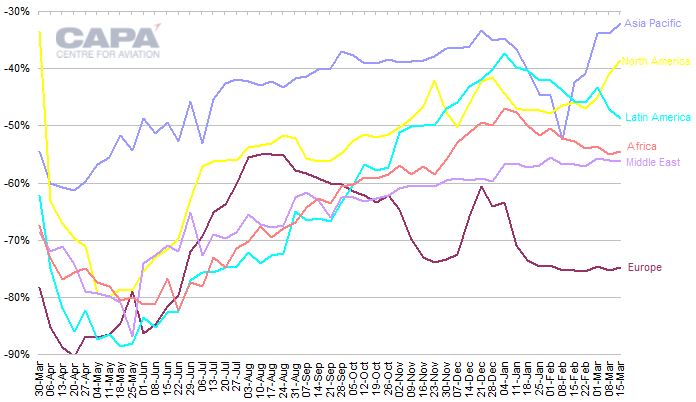

Europe has been the worst performing region for five months

Ranked by the percentage decline in capacity versus 2019, Europe has been at the bottom of the regional league table since mid October 2020.

Europe’s 74.8% cut in seat numbers is 18.5ppts adrift of the next deepest, the Middle East, which is down by 56.3% this week.

Africa’s seat count is down by 54.5%, Latin America’s by 48.7%, North America’s by 38.6% and Asia Pacific’s by 32.2%.

North America and Asia Pacific have enjoyed an improvement in the trend of seats versus 2019 levels this week, whereas Latin America has taken a downward step.

Europe, Middle East and Africa are at a similar percentage of 2019 capacity as they were last week.

Percentage change in passenger seat capacity vs 2019 by region, week of March 30, 2020 to week of March 15, 2021

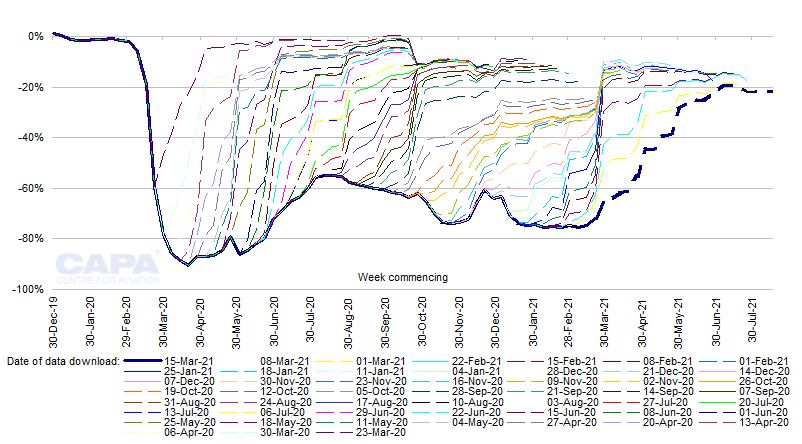

Summer 2021 schedules are projecting too rapid a recovery

Capacity derived from current schedules for March 2021 is now projected to be down by 74% from 2019 levels, compared with -73% projected a week ago. This follows a 75% fall in February 2021 and a 71% drop in January 2021.

Looking to the first months of the summer 2021 schedule, airlines have reduced planned 2Q2021 capacity in Europe by 10% since last week. Nevertheless, 2Q2021 is still projected to be at 56% of 2019 seat capacity – a big increase on the 27% level of 1Q2021.

April 2021 capacity has been cut by 18% since last week and is now projected at 37% of 2019 capacity. This is starting to look more realistic, having been projected at more than 50% as recently as two weeks ago.

However, May 2021 is projected at 59% and June 2021 at 74% of 2019 capacity.

The first month of 3Q2021, July 2021, is currently projected at 80% of 2019 seat numbers, a figure that – even nearly five months ahead of time – looks far too optimistic.

Anne Rigail, CEO of Air France – one of Europe’s leading legacy airlines – told CAPA Live on March 10, 2021 that achieving 70% of 2019 capacity in 3Q2020 would be a very good outcome. She added that the airline had repeatedly pushed back its restart forecasts throughout the crisis.

As the chart below highlights, airline schedules filed with OAG have been consistently overly optimistic throughout the pandemic.

As the COVID-19 crisis moves into its second year, there has yet to be a single week when capacity projections derived from filed schedules have not been revised downwards in subsequent weeks.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, with outlook at different dates*

EUROCONTROL does not see significant activity planned for April 2021…

EUROCONTROL Director General Eamonn Brennan told CAPA Live on March 10, 2021 that his organisation would be able to handle the ramping up of capacity when it comes.

He explained that files scheduled with OAG were less of an indication of airline operational commitments than flight plans filed with EUROCONTROL.

“When they file the flight plans, there’s a better chance because they have fuel lot loads and crews and it’s more of a mental commitment”, he said.

He noted that airlines were not yet filing significant flights plans for April 2021, indicating that it would likely remain a quiet month.

…but flight plans are picking up across the summer

Nevertheless, Mr Brennan said flight plans were more significant for May 2021 through to August 2021, although he expected a later summer peak in Europe this year (in July, August and September).

He predicted that the recovery would be led by tourism from Northern Europe, starting with the UK, to the southern European/Mediterranean nations.

EUROCONTROL was seeing almost no significant sign of long haul operations before July 2021, with North America emerging as the most important long haul destination from Europe at that time.

UK and US could lead the long haul restart

The UK and US are leading the vaccination roll-out among the larger nations of the world, measured by doses per 100 people.

As a result, Mr Brennan predicted: “I think you might see a confluence with the UK and the United States starting off in the North Atlantic. And I see reasonable North Atlantic operations resuming from August, September”.

Nevertheless, with respect to Asia (where vaccination rates are lower), the recovery is likely to take longer to start. “I don’t see big operations to Australia until maybe November, December, if that”, he said, “and then China around that time”.

This chimes with a CAPA analysis report of February 24, 2021: UK-US air travel may lead Europe’s long haul recovery.

February 2021 and March 2021 flight numbers have beaten EUROCONTROL expectations

On January 28, 2021 EUROCONTROL published traffic scenarios for upside and downside cases on the evolution of flight numbers in the period February 2021 to June 2021.

See related report: European aviation: bottoming out, but no sharp rise likely

So far, the out-turn has been above its upper scenario. February 2021 movements were down by 66% versus 2019, compared with its scenario range of -72% to -74%.

Traffic in the first two days of March 2021 was down by 65%, compared with its full month scenario range of -72% to -77%. (Note that the number of flights has performed around 10ppts better than seat capacity as a percentage of 2019 levels.)

Although the trend has been above EUROCONTROL’s expectations, flight numbers are still at very depressed levels, with February 2021 and March 2021 slightly below January 2021.

European aviation can expect activity to climb through the summer

That said, the agency's data support CAPA's view that European aviation activity is bumping along the bottom in anticipation of a summer climb (although, of course, significant uncertainties remain concerning new variants of the virus, vaccination progress, and government policies on travel restrictions).

See related report: European aviation. Seats and fleets point to 2Q2021 recovery

As noted above, current schedules filed with OAG are too optimistic with regard to summer 2021 seat capacity in Europe.

Nevertheless, the capacity curve is likely to slope upwards in 2Q2021, even if is not as steep as schedules suggest, and to climb more steeply in 3Q2021.

More Travel News:

WTTC calls on Europe to ramp up vaccine rollouts

Skyscanner Weekly Travel Insights

WestJet and Delta launch reciprocal top-tier benefits as part of ongoing focus on guest experience

Break free with a beachfront wellness Work-Away Program from Palmaïa – The House of AïA!