Where travel agents earn, learn and save!

News / CAPA Live: Americas aviation update, April 2021

A summary of the latest key developments by region

In North America – impressive capacity increases amid lower COVID cases

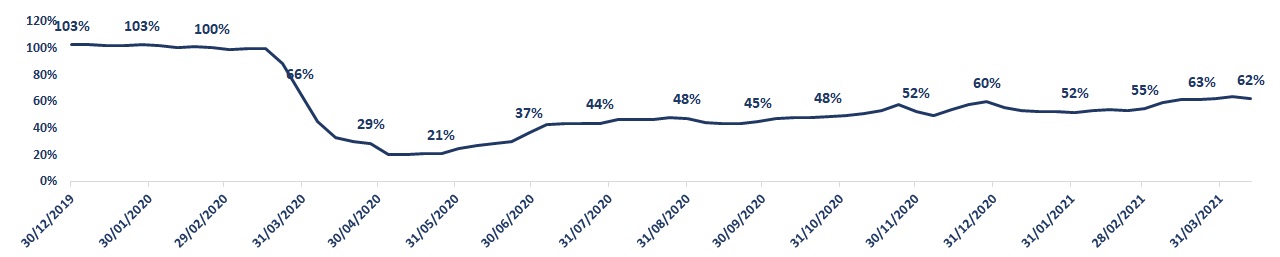

North America: total capacity as a percentage of 2019 levels, December 30, 2019 to March 31, 2021

Taking a look through April’s Americas regional dashboard, data shows that North America was the second most impressive region this month after Europe, with a 15ppts increase in capacity compared to the prior month.

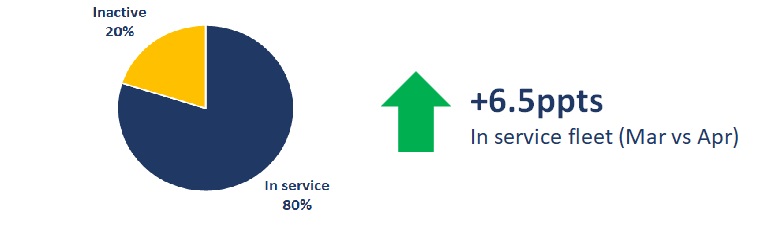

This is largely due to the 6.5ppts increase in the aircraft fleet in service in the region.

North America: ASK, total seat capacity and total cargo capacity, March 2021 vs April 2021

North America fleet: March 2021 vs April 2021

South America represents the only region with negative growth in April

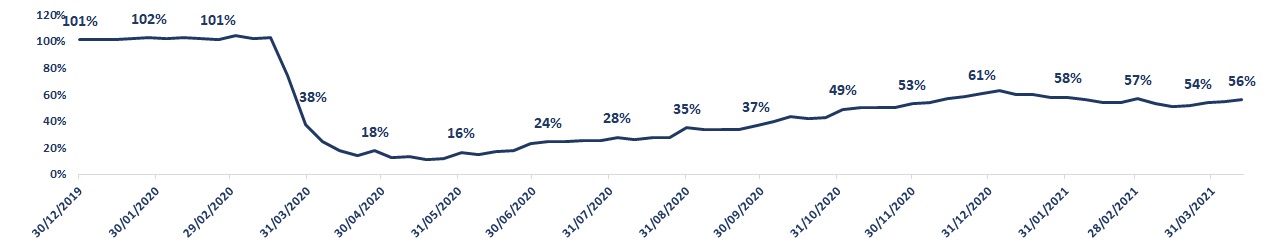

South America: total capacity as a percentage of 2019 levels, December 30, 2019 to March 31, 2021

South America is the only region in Apr-2021 that showed declines in the dashboard indicators.

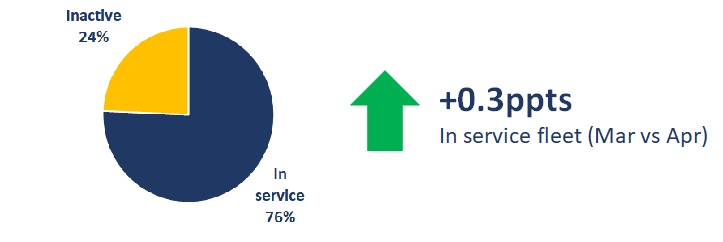

Although the number of aircraft in service rose, albeit very slightly, capacity declined, by almost 8ppts. This is mainly attributed to Brazil’s increasingly difficult situation dealing with COVID-19.

South America: ASK, total seat capacity and total cargo capacity, March 2021 vs April 2021

South America Fleet, March 2021 vs April 2021

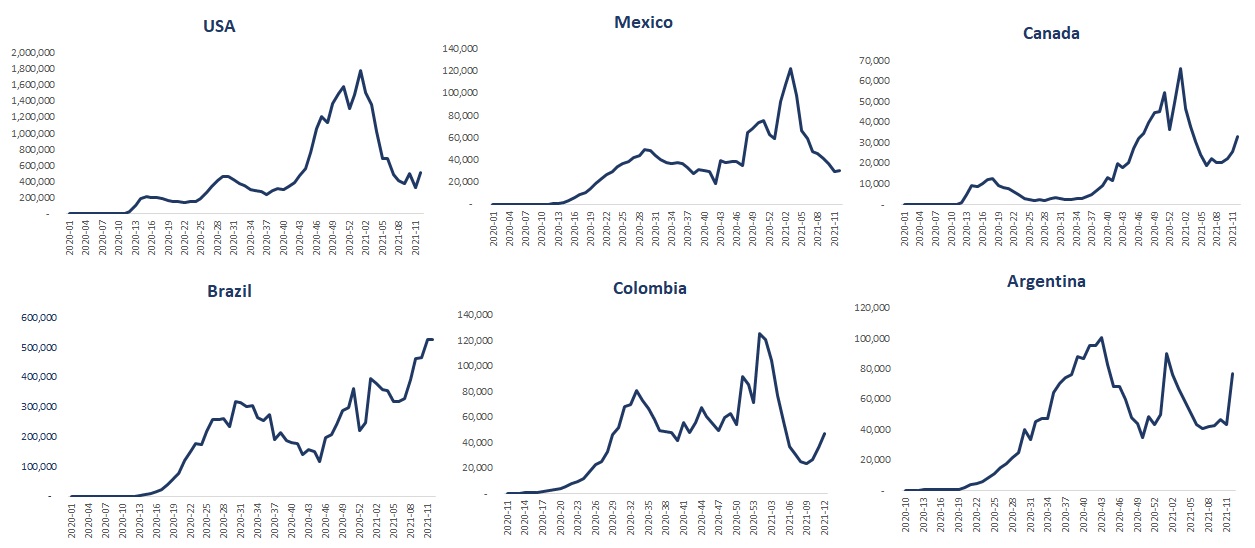

Americas: COVID-19 cases per country

Americas: COVID-19 cases per country

In North America there have been increases in weekly COVID-19 infections during March 2021, largely driven by the USA, where numbers had earlier fallen from their January 2021 peak.

Mexico has also managed to reduce the number of new cases significantly, whereas in Canada there have recently been near-record levels of new infections.

In South America, Brazil is currently amid one of the worst situations globally. Infections are at a record high, and recent reports suggest that the hospital system continues to be under immense strain.

The concerning data point for Brazil is that that COVID-19 deaths are now exceeding earlier peaks. Other South American nations such as Colombia and Argentina are also experiencing a new wave of the virus. CAPA will be taking a look at what these increases have meant for aviation capacity in a moment.

Americas: COVID-19, new weekly cases per country

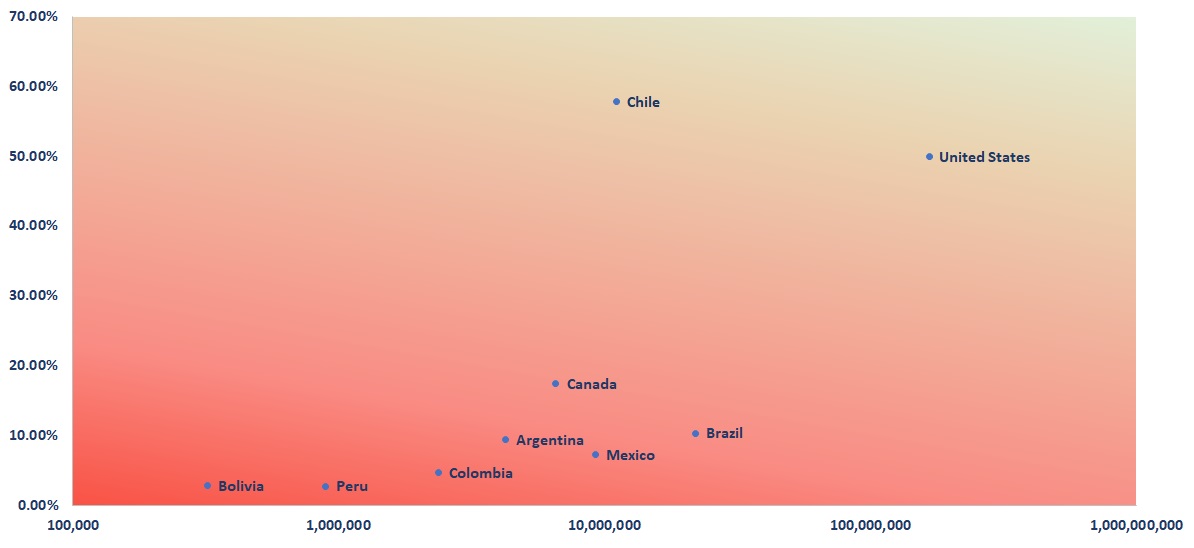

Americas: COVID-19 vaccinations per country

Americas: COVID-19 vaccinations per country

Taking a look at where some of the major markets within the region are up to in their COVID-19 vaccination rollout: along the vertical axis is the percentage of the population that has currently received one or more doses, and along the horizontal axis is the total number in the population that has received a vaccine.

As can be seen, many countries are struggling to roll out the vaccine programme, largely due to supply issues, however one country is ahead of the pack, and demonstrating one of the most successful vaccine rollouts in the world – and that’s the USA.

As much as 52% of the population have now received one or more vaccination shots, and last week the country broke the record of the highest number of vaccines administered in one day, at more than 4 million.

Americas: current COVID-19 vaccination rates, total number and percentage of the country’s population

USA: a remarkable domestic recovery amid testing times

USA: a remarkable domestic recovery amid testing times

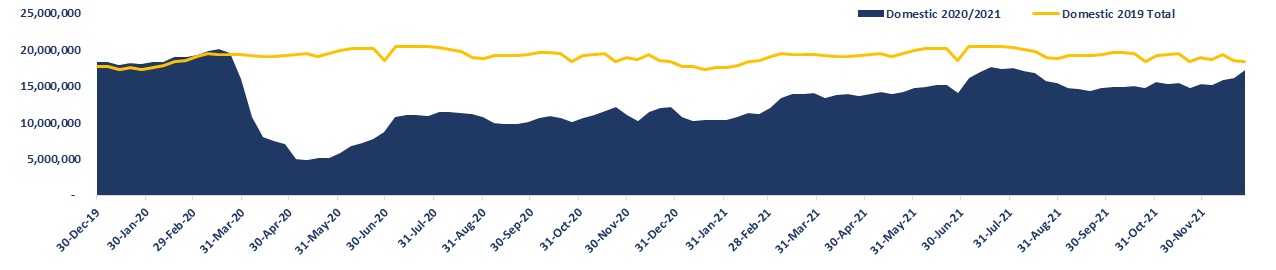

It’s clear that the USA has experienced significantly high levels of COVID-19 infection, but what is surprising is the level to which the American domestic market has recovered; as optimism grows, or as some commentators have argued, ‘Americans are done with the virus, even if the virus isn’t done with Americans’.

Unlike most other countries with high infection rates, such as those in mainland Europe, the USA has had a far more liberal approach to travel and movement, leading to peaks in travel over Thanksgiving in November 2020 and Christmas 2020. But in recent weeks domestic capacity has even exceeded those peaks, and continues to climb back towards that all-important 2019 benchmark.

With the summer season approaching it’s projected that capacity will continue and reach a new peak of capacity. What is interesting is that airlines such as American Airlines are planning to reactivate fleet to meet demand, and others are proactively rehiring crew.

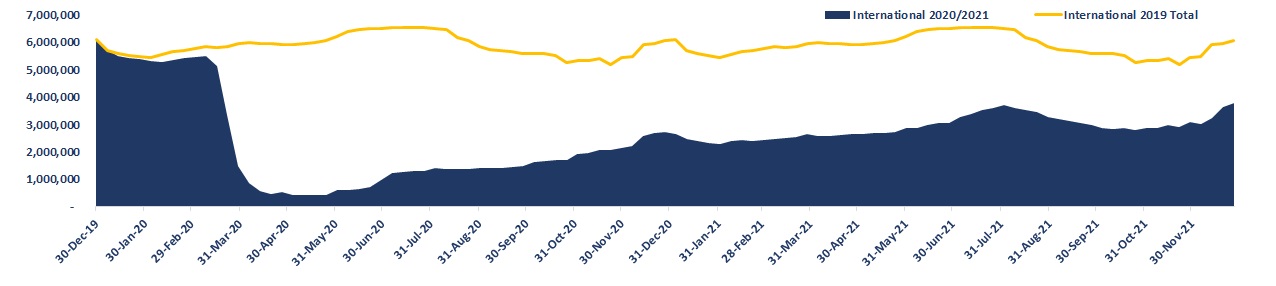

International capacity also continues to rise, although not as quickly as in domestic. That having been said, international capacity is now far higher than what was seen in the first wave of COVID in April 2020.

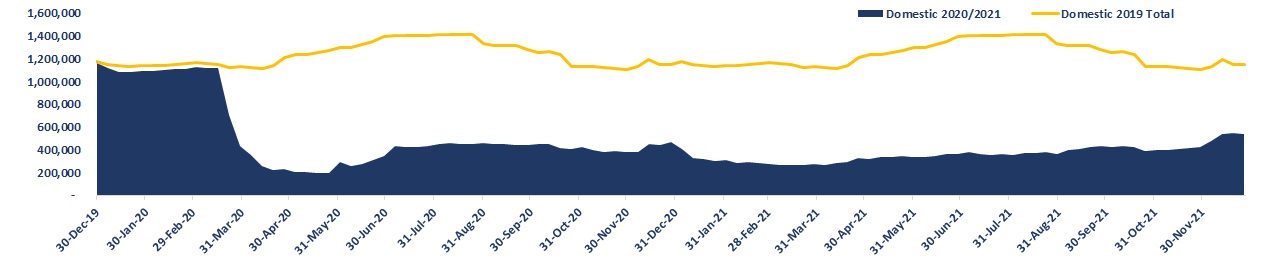

USA: domestic capacity, December 2019 to December 2021

USA: international capacity, December 2019 to December 2021

Canada: still at near record lows in capacity, even domestically

Canada: still at near record lows in capacity, even domestically

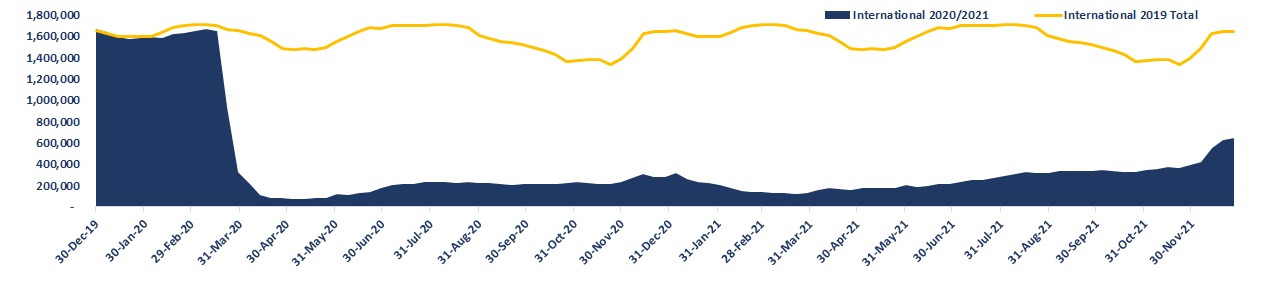

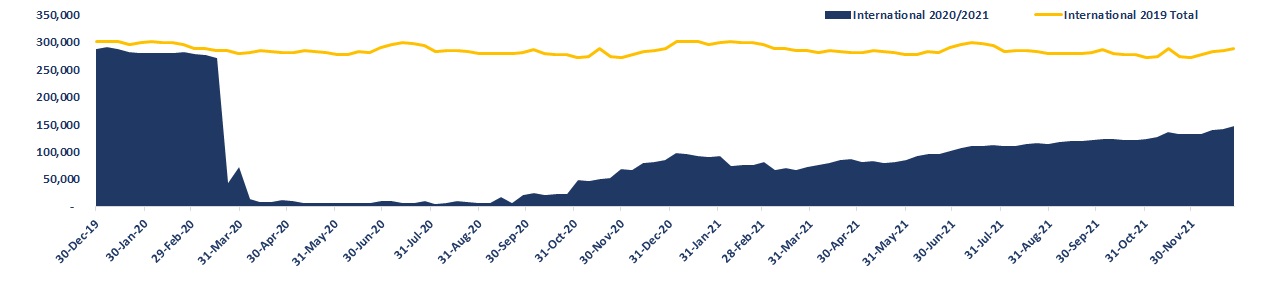

With the USA’s international capacity exceeding many expectations, it’s natural to look at the destinations of those seats. Typically, much of this capacity would head north towards Canada, however from the data, this is clearly not the case.

International capacity for Canada remains at near record lows, ever since the first wave of COVID-19. Domestic capacity for Canada also remains significantly supressed, and with cases continuing to rise, projections for the country are not as optimistic as for its southern neighbours.

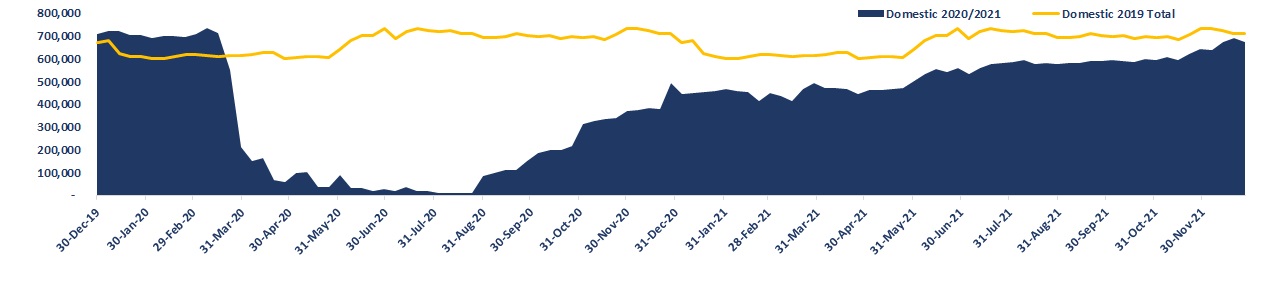

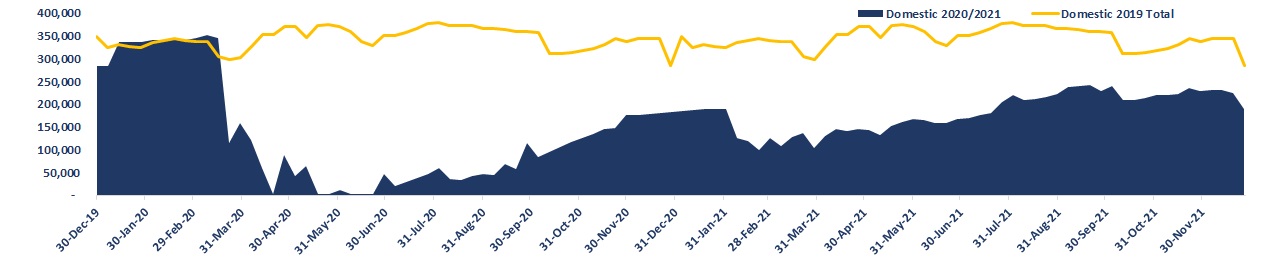

Canada: domestic capacity, December 2019 to December 2021

Canada: international capacity, December 2019 to December 2021

Mexico: an impressive domestic and international capacity recovery

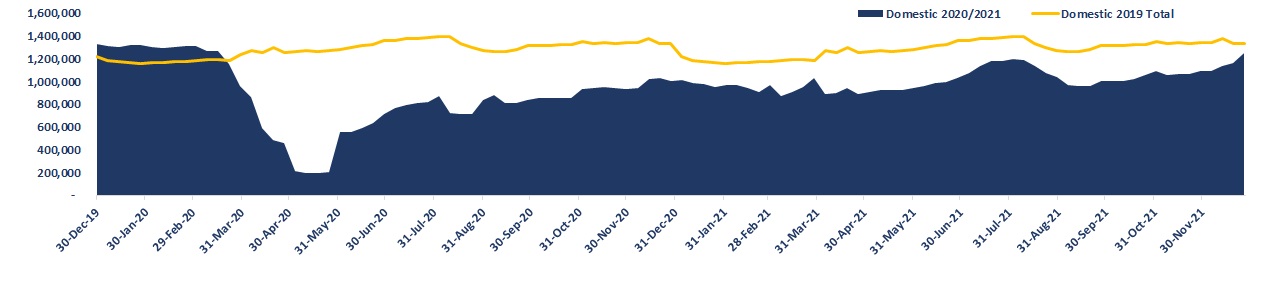

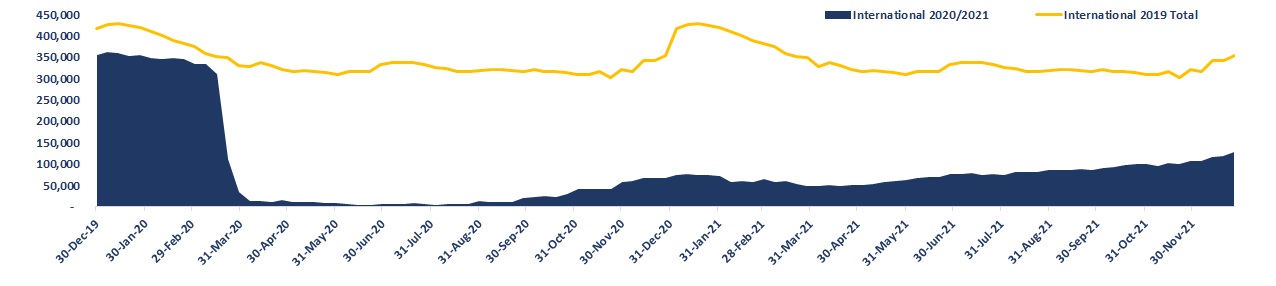

Mexico’s new COVID-19 cases have followed a similar pattern to that of the USA, with a large peak over the January 2021 period.

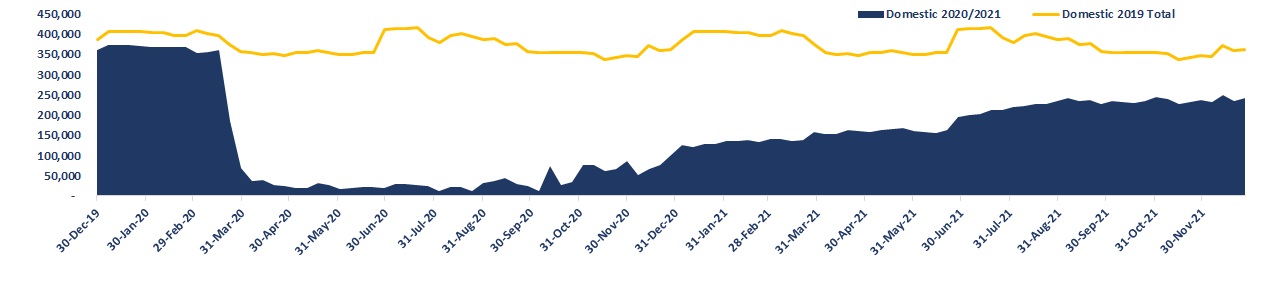

However, what is obvious as a direct comparison is the fact that domestic capacity has recovered significantly. As the calendar crossed into April 2021 capacity was at 83% of 2019 levels, one of the most impressive domestic recoveries in the region, and certainly one of the most impressive cases of recovery in a country that still has high infection rates.

Something to look out for will be what happens over the summer months as US travellers continues to fly abroad; much of this capacity is likely to head to top tourist destinations in Mexico.

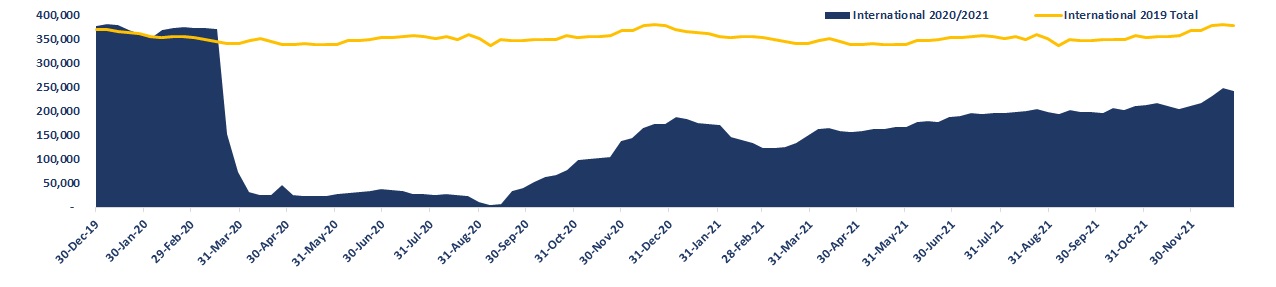

Mexico: domestic capacity, December 2019 to December 2021

Mexico: international capacity, December 2019 to December 2021

Colombia: despite high COVID-19 infections, capacity growth is gaining momentum

Colombia: despite high COVID-19 infections, capacity growth is gaining momentum

Colombia is, once again, another example of high infection rates, but clearly this hasn’t deterred travellers from flying – especially domestically.

Both the domestic and the international projections for the country are positive.

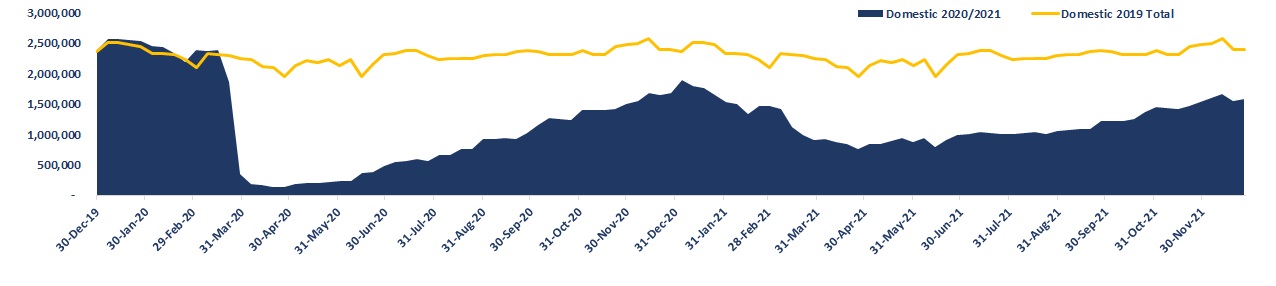

Colombia: domestic capacity, December 2019 to December 2021

Colombia: international capacity, December 2019 to December 2021

Brazil: battling COVID-19 may mean supressed capacity for some time

Brazil: battling COVID-19 may mean supressed capacity for some time

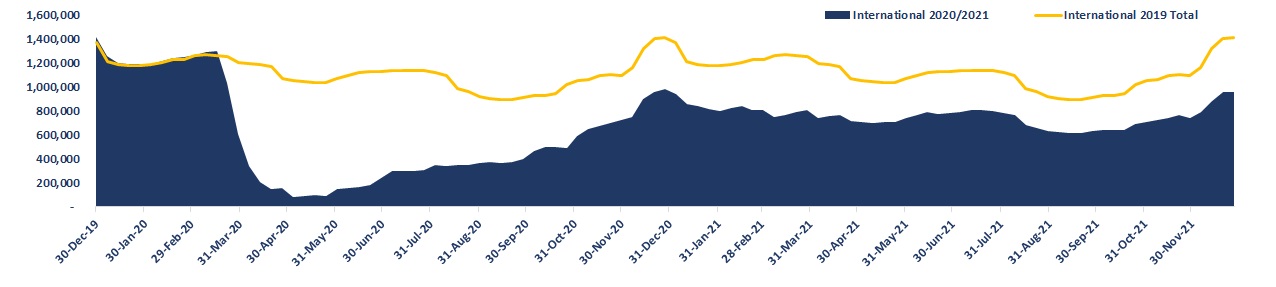

Despite suffering from one of the worst COVID-19 situations globally, Brazil’s domestic capacity recovered strongly in the latter half of 2020.

However, with the increase in cases capacity has now begun to fall, since January 2021.

International capacity remains low, and although decreasing, is expected to rise over the summer if the COVID situation is brought under control. Until then, local holiday-makers are expected to travel domestically and international visitors are likely to stay away.

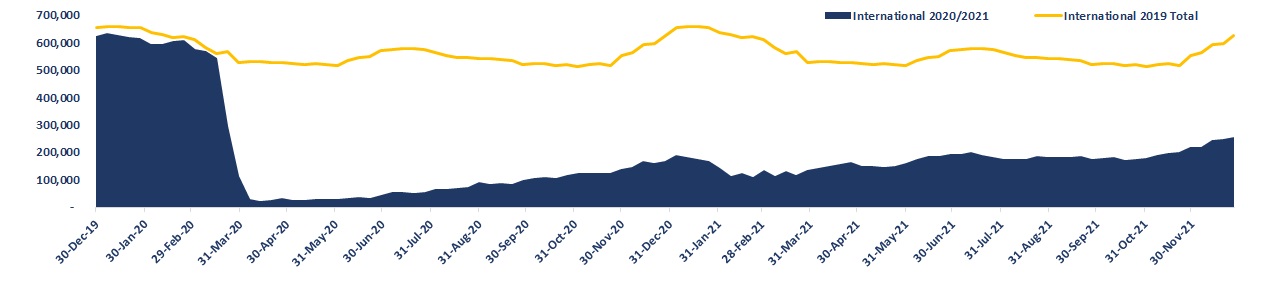

Brazil: domestic capacity, December 2019 to December 2021

Brazil: international capacity December 2019 to December 2021

Peru: a small market with small capacity gains

Peru: a small market with small capacity gains

Peru is struggling with a new wave of COVID-19 infections, however, interestingly, unlike the case with many of its close neighbours, capacity hasn’t increased as much.

International capacity remains very low, and domestic is currently at only 37% of 2019 levels. It is worth noting that Peru’s aviation market is relatively small, therefore may be susceptible to other external forces during its recovery.

Peru: domestic capacity, December 2019 to December 2021

Peru: international capacity, December 2019 to December 2021

Argentina: bucking the trend in South America

Argentina: bucking the trend in South America

Argentina – a country that appears to have bucked the trend of the continent. With high levels of COVID-19 infections remaining in the country, capacity has not really increased all that much throughout 2020.

Since the start of 2021 capacity has remained level overall, however while domestic seats have increased, international capacity has declined.

Argentina: domestic capacity, December 2019 to December 2021

Argentina: international capacity, December 2019 to December 2021

Americas summary

Americas summary

Something that’s super interesting to note from the Americas region is that although COVID-19 remains prevalent in almost all countries, capacity has recovered at astonishing rates.

Without comparing it to the likes of China and South Korea, where COVID-19 infections have been all but eliminated, Latin American countries seem to be taking a completely different strategy.

The USA and China currently have similar levels of domestic capacity, but the former nation has one of the highest infection rates globally, whereas China has one of the lowest. It’ll be interesting to see what the future holds for aviation in the countries within the Americas region once the virus is brought under control.

More Travel News:

IATA: Reduced losses but continued pain in 2021

Alaska Airlines commits to carbon, waste and water goals for 2025, announces path to net zero by 2040

American travelers getting vaccinated rapidly

WTTC reveals U.S. Travel & Tourism sector suffered loss of $766 billion in 2020April