Where travel agents earn, learn and save!

News / US full service airlines on the brink as business demand drops

Just as US airlines thought they saw the light at the end of the tunnel, the Delta train is staring down a recovery

Just as US airlines thought they saw the light at the end of the tunnel, the Delta train is staring down a recovery.

The fairly successful return of summer leisure traffic – although at low yields – peaked in July 2021, and the nation’s full service carriers had been optimistic about a post-Labor Day return of business flying. This is the time when yields are supposed to rise, as companies get back to work in what is usually a busy four months leading up to year end.

But this year it’s not going to happen. As the Delta variant wreaks havoc among the unvaccinated, many major US companies are delaying any return to office working until 2022, and signs are clearly showing that travel plans are following suit. While international markets still remain either closed or at best difficult, that means domestic business traffic too is going to be heavily diluted at least until the new year.

Previously optimistic noises from the airlines are now becoming more muted. The obvious correlation between infections and business hesitancy means any recovery will be delayed until there is greater certainty about the safety of travelling.

With the Delta variant rampant, and now the Mu variant, uncertainty is the order of the day. This has significant implications in the short term for airline revenues and jobs; it also raises the question of whether government will still be prepared to step in with a further round of support, if business doesn’t improve.

How fast things have changed

The USA was hailed as one of the front runners in vaccine distribution earlier this year – a welcome accolade the country needed after being hardest hit since the pandemic began.

However, the vaccine rollout has slowed, and with the Delta variant now spreading rapidly, a perfect storm is here. US airlines will now be navigating through an ugly three-month period of low leisure/VFR demand as the summer vacation period fades and business traffic evaporates.

None saw it coming at second quarter earnings calls, just a few weeks ago. As recently as mid-June 2021, American Airlines announced that with strong bookings, the carrier expected that strength to continue through the end of 2Q2021 and into 3Q2021, assuming continuation of the trend. It added that although business demand continued to be weak, it had seen increased demand among small and medium sized enterprises and certain large corporate customers.

Frontier Airlines was among the last US airlines to report 2Q2021 earnings, and the first to warn that demand was softening over seasonal norms due to the Delta variant.

Shortly afterwards, Southwest Airlines also lowered its operating revenue guidance for August 2021 to down 15% to 20% compared with 2019, versus a previous estimate of a decrease between 12% and 17%. The airline highlighted a deceleration in close-in bookings, and a rise in close-in cancellations – again due to the Delta variant.

Southwest has explained that given the negative effects of the pandemic on August 2021 and September 2021 revenue trends, it would be difficult for it to be profitable in 3Q2021, barring payroll support from the US government.

Ultra-low cost carrier Spirit has also warned that operational challenges and a slowdown in demand due to the Delta variant would drive an additional USD80 million to USD100 million of negative revenue impact in 3Q2021.

And, by end-August 2021 American’s chief revenue officer, Vasu Raja, was reporting, “This has been, and we expect will continue to be, a very choppy recovery. We do anticipate that there will be a…slower recovery in business demand than what we’ve seen". (BTN, August 26, 2021)

A "pandemic of the unvaccinated" is driving the infections uptick

The new burst of infections is now being described as the pandemic of the unvaccinated, and in the US there are still 90 million people still to be vaccinated as take-up has slowed dramatically.

As COVID cases rise, passenger numbers fall

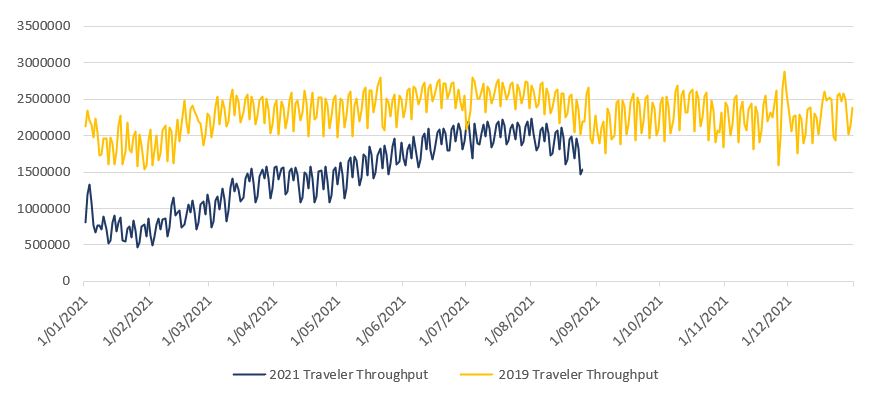

The impact of the Delta variant is borne out by recent Transport Security Administration (TSA) security checkpoint throughput data.

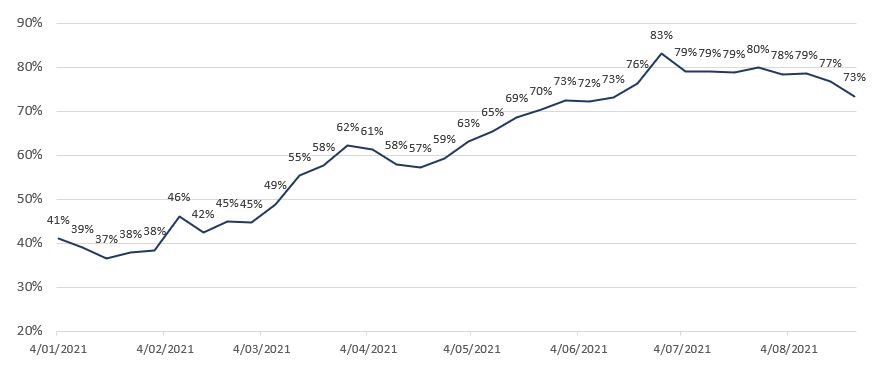

This shows that passenger number gains at US airports went into reverse as September 2021 ticked over, having peaked at 80% of 2019 levels in late July 2021.

TSA daily throughput of passengers in the US

With summer fading that figure has fallen significantly, to 73% of 2019 levels, and seemingly trending downwards.

TSA weekly throughput of passengers in the US, as a percentage of 2019

As the summer season ends, corporate travel should accelerate....

Airline revenues in the US typically rely on corporate flying to kick in after early-September’s Labor Day to stimulate capacity levels and cash flows for the airlines in the last part of the year.

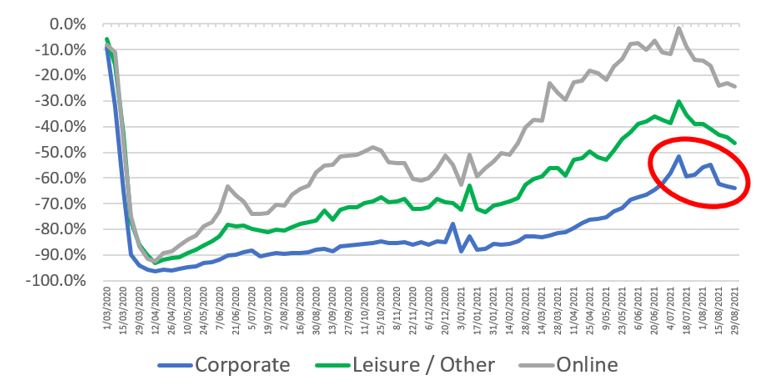

However, the evidence now is that companies remain hesitant to let employees fly in such a volatile situation. Corporate air ticket forward sales started to retreat through late Jul-2021 and into August 2021.

US corporate travel air ticket sales weaken again in late August 2021

Many major companies have delayed office reopening until 2022

These trends are unlikely to turn around soon, as many major corporates have, in recent days, announced office reopening delays.

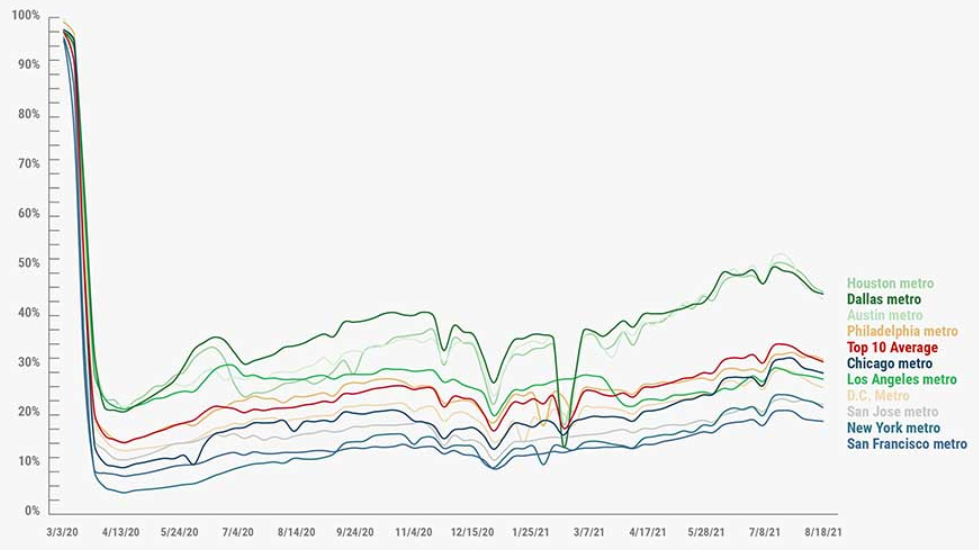

Key US city workers leave the office for the summer

Companies cite their duty of care to their employees, as well as wanting to avoid the disruptions by declaring constant return dates that are then followed by further delays.

By extending the period into 2022, the hope is there won’t need to be another adjustment.

Selected US corporations’ office reopening delays

| Corporation | Office reopening delays and other staff policies |

| Apple Inc | Delayed its return to corporate offices from October 2021 to January 2022 at the earliest |

| Amazon | Delays reopening of its US offices until January 3, 2022 |

| Capital One Financial Corp | Postponing return-to-office dates |

| Announced teams in the US will not be required to go back to the office until January 2022 | |

| Delayed office reopening from September 7, 2021 to October 18, 2021, then to January 2022 | |

| John Hancock | Pushed back its planned reopening of offices from September 20, 2021 until January 2022 |

| McDonald’s Corp | All of the company’s US corporate workers must be fully vaccinated by September 27, 2021. Postponed the official reopening date of its headquarters and other domestic offices from September 7, 2021 to October 11, 2021 |

| Microsoft | Delayed its plans for returning to the office from September 7, 2021 to 04-Oct-2021 and will require workers to be vaccinated |

| NBCUniversal | Postponing return-to-office dates |

| PwC | Delayed reopening of its US offices until at least November 1, 2021 |

| Moved back office reopening plans by about a month to October2021 | |

| Uber | Delayed reopening until at least January 2022 |

| Wells Fargo | Delayed office reopening from September 7, 2021 to October 4, 2021 |

There is an inverse correlation between office reopenings and corporate travel

There is a close (inverse) correlation between office reopenings and corporate travel.

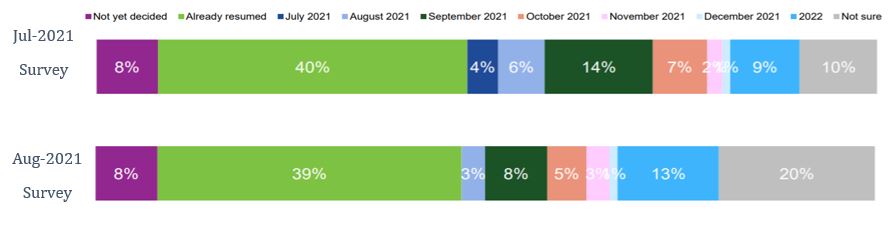

As more companies press pause on office reopenings in face of the Delta variant there are, in turn, rising levels of uncertainty among corporate travel buyers around the likely timing for some 60% of corporations who are yet to resume domestic business travel.

In July 2021 only 10% of US companies were unsure as to when they would resume corporate travel, according to GBTA.

By the following month this number had doubled to 20%. Far fewer companies are now sure of when they will commence corporate travel, with 13% not expecting it to happen this year at all.

In view of recent rapidly escalating trends, this number will likely only increase.

Domestic corporate travel uncertainty soars month-on-month

International travel uncertainty has also grown, as just 9% of US corporations have resumed corporate travel. In July 2021, 27% of businesses were not sure when international travel would commence; by Aug-2021 this number grew to 35%.

Business travel behaviour will be different in future

Aside from the impact of COVID-19, there are also widely publicized accounts that business travel across the board will be reduced in future, whether to reduce companies’ carbon footprint or to save on costs.

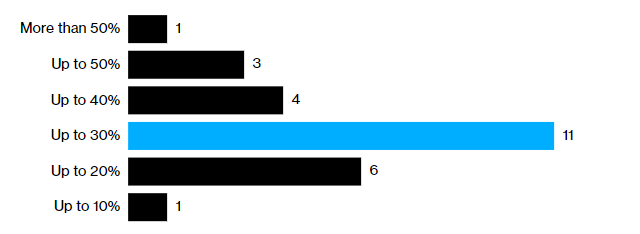

According to a Bloomberg News Survey of 45 large businesses in the US, Europe and Asia, most of the companies surveyed said they plan to reduce the amount of flying after the pandemic.

Number of respondents that stated whether their company would be flying more, less or the same after the pandemic

Unsurprisingly, this also coincided with an expected fall in travel budgets after the pandemic, with 84% of respondents stating that travel budgets for their companies will be cut by up to 30%.

Amount that respondents expected travel budgets to be cut by

Equally, in a survey conducted by Morning Consult on behalf of the American Hotel and Lodging Association (AHLA) of 1590 people who are likely to attend large gatherings, meetings and events: 67% of respondents plan on taking fewer trips, 52% said they were likely to cancel existing trips without rescheduling, and 60% were planning to postpone plans.

According to a Deloitte survey, 2021 will see only 30% of the regular corporate travel made in 2019, costing the hotel industry USD59 billion.

Need now for a rethink of strategies as revenue projections slide?

Despite an early impressive vaccine rollout and increase in capacity in the US throughout the latter half of 2020 and the first half of 2021, the situation is changing rapidly.

With slowing vaccine take-up rates and soaring cases of the Delta variant of COVID-19, the pandemic continues to cause big problems for recovery.

The Delta variant has the potential to prolong the pain for US airlines as there appears to have been a rapid shift in sentiment, reflected in bookings, for business travel in the US at the crucial post-summer changeover point from holiday travel.

This is going to mean airlines – particularly full service airlines that rely substantially on business traffic – are now likely to have to be reassessing their end-2022 planning.

As hopes for the post-Labor Day business travel surge fade, so do revenue outlooks. The much-needed shot in the financial arm is not going to happen, and is unlikely to do so until ways of living with COVID-19 are achieved.

Consequently, many airlines will be forced to consider scaling back on previous plans, raising the prospect of job reductions and fleet reorganization. Whether government retains an appetite to continue supporting the industry will become increasingly relevant, even though most airlines still have substantial war chests.

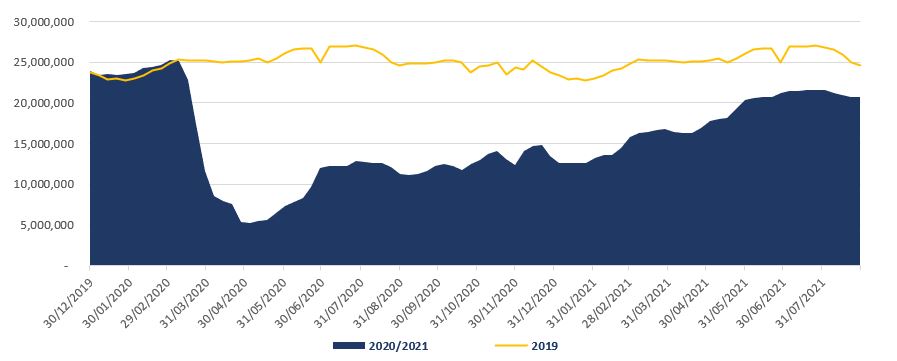

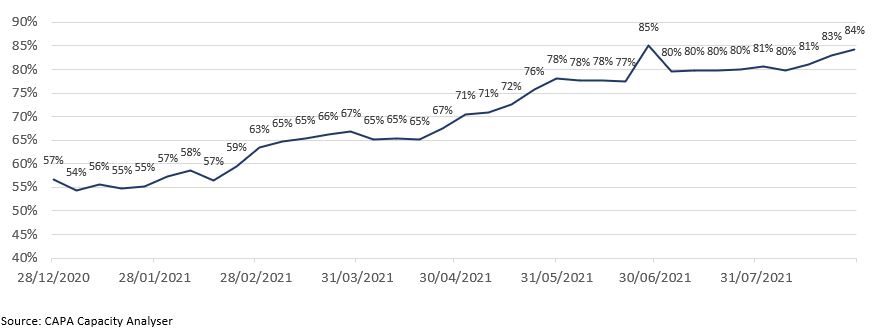

Total US capacity 2020 and 2021

Despite total capacity falling slightly in August 2021, this is to be expected as the seasonal decline in capacity is usual after the summer peak; however what remains impressive is that capacity relative to 2019 weekly levels continues to rise. During Aug-2021, relative capacity rose from 80% to 84% of 2019 levels.

An increase in relative capacity has been almost exponential since the beginning of 2021, with a significant peak over the 4th July weekend.

2021 capacity as a percentage of 2019 total weekly seats

Many airlines have led an agenda of optimism when it comes to capacity recovery.

American Airlines, United Airlines, Delta Air Lines and Southwest Airlines all made ambitious and impressive increases in capacity during the summer period. However, as leisure travel subsides there is a clear division between the carriers.

American Airlines has significantly scaled back operations and Southwest has begun a slight decrease in capacity. However Delta, although decreasing capacity, remains on a positive trajectory compared to 2019 levels.

More surprisingly, United Airlines have retained a strong position and are not cutting back capacity, despite the national trend of decreasing passenger numbers.